Whereas levered free cash flow is the amount of money a business has after it meets all of its financial obligations, unlevered free cash flow is the amount of cash a business has before paying off these obligations. When it comes to levered free cash flow vs unlevered free cash flow, the key difference is expenses. Levered free cash flow vs unlevered free cash flow However, investing in this space could lead to greater profitability in the long-term.

For example, if you’ve made capital investments into a physical space, such as a new warehouse, then you may end up with a negative amount. Having said that, a company with negative levered free cash flow could still be profitable and financially healthy. If a business has a negative levered free cash flow, it’s probably a risky investment. This is because your company’s operating cash flow simply isn’t enough to cover all of your business’s financial obligations. What does a negative levered free cash flow mean?Īfter working out your company’s levered free cash flow, you could be left with a negative amount, even if your operating cash flow is positive. Working Capital – This refers to the total amount of working capital that a company has available to it.Ĭapital Expenditures – These are investments in fixed assets made by a company, such as land, buildings, or equipment. Mandatory Debt Payments – This is everything a company owes to debtors. In essence, it’s a way to determine the overall financial performance of a company. Here’s what these terms mean in a little more detail:ĮBITDA – This stands for earnings before interest, taxes, depreciation and amortization. LFCF = EBITDA – Mandatory Debt Payments – Change in Net Working Capital – Capital Expenditures The levered free cash flow formula is as follows: Levered free cash flow is relatively simple to work out, although you will need to know a couple of key pieces of information beforehand. In real terms, levered free cash flow is a useful way to measure a company’s ability to pay shareholders and expand its business, while it may also be a good indication of whether a company will be able to obtain additional capital through financing. Levered is just another name for debt, so if cash flows are “levered”, it means that they’re net of interest payments. Levered free cash flow (LFCF) measures the amount of money a company has left in its accounts after it has paid all of its short and long-term financial obligations (such as interest payments and operating expenses).

#LEVERED VS UNLEVERED CASH FLOW FORMULA HOW TO#

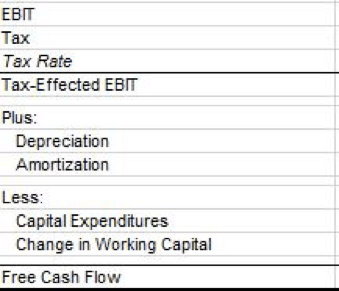

Find out how to calculate levered free cash flow, and more. Maybe I am overseeing something and both are actually the same thing, but an explanation would be appreciated nevertheless.Looking at cash flow is a great way for investors to check the financial health of a business, while calculating levered free cash flow is one of the most effective ways to determine profitability. To me, there are mainly two differences in these calculations which I don't understand: 1.) Why do you start from EBIT in the DCF model but from EBITDA in the LBO model? 2.) Why do you restate the taxes in the DCF model by taking them from EBITA and in the LBO model you take them from the taxable income (= PBT + non-tax deductible interest expense)? Unfortunately I couldn't find an explanation for this and thus wanted to ask whether anyone can explain to me why different calculations are being used.įCF calculation for DCF model: EBIT + Amortization of non-deductible goodwill = EBITA - Taxes on EBITA + D&A + Changes in deferred taxes - Capex - Increase in NWC = Unlevered FCFįCF calculation for lbo model: EBITDA - Net Interest expense - Income taxes (taken from taxable PBT) - Capex - Increase in NWC = FCF While reviewing the FCF definitions in DCF and lbo models, I noticed that they are slightly differently calculated.

0 kommentar(er)

0 kommentar(er)